Protect the Trade equity

Horizontal support

Historically strong enough to prevent the price from falling

Trendline support

It helps traders identify potential levels of support

Dynamic support

Technical analysis that refers to a moving level of support

Viewing support

Analyzing or interpreting support levels on a price chart

Realistic and achievable goals

Establishing realistic and achievable goals is a cornerstone of a successful trading strategy. Clear and well-defined objectives serve as a roadmap for navigating the complexities of the financial markets. When setting goals in the context of trading, several principles can guide this process.Consideration of risk tolerance is paramount. Goals should be challenging yet within the boundaries of your comfort level with risk.

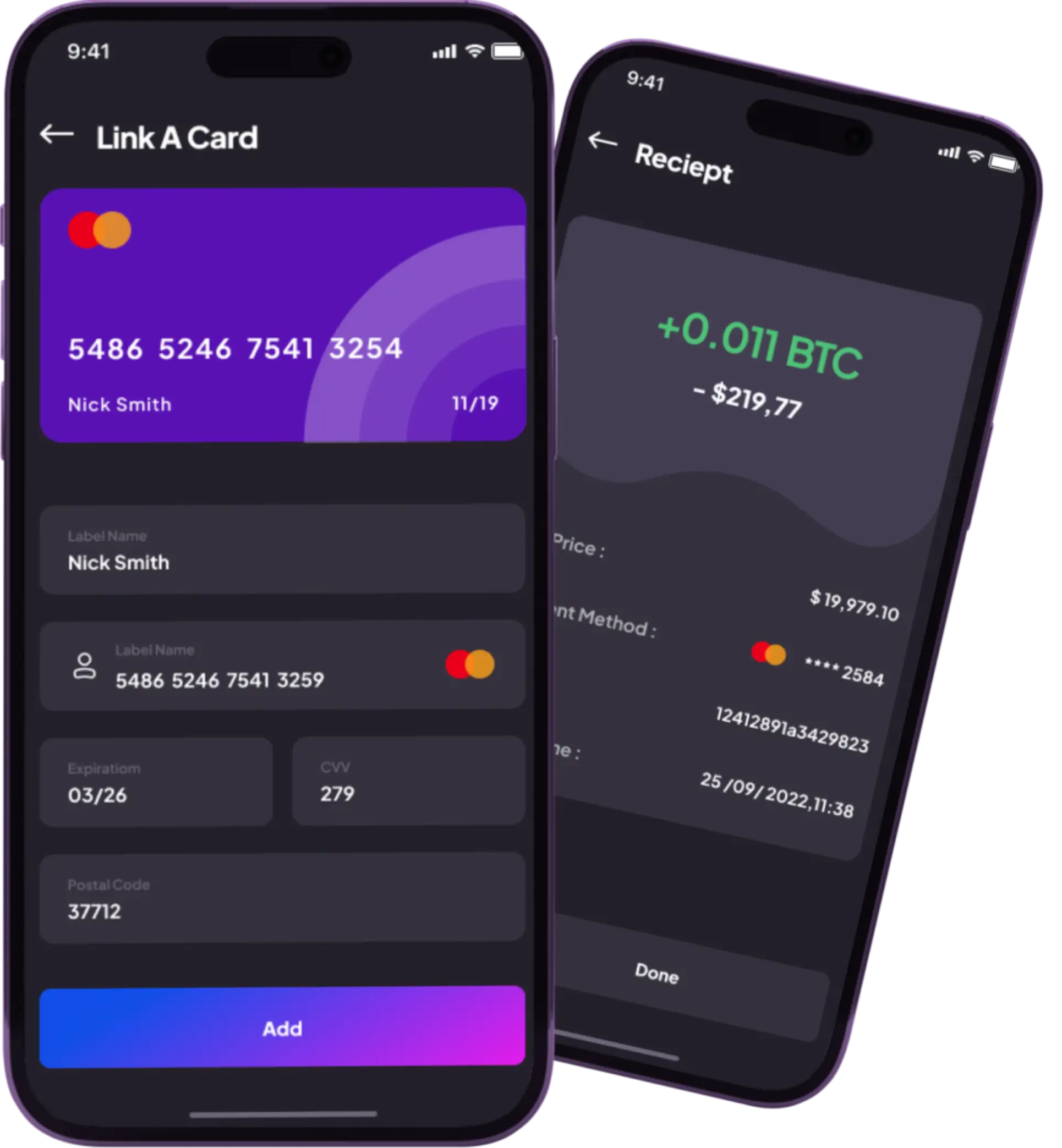

PRICE CONTROL

Trading support levels can serve as entry points for significant market

Indeed, trading near support levels is a strategy that many traders use to identify potential entry points for significant market moves. Support levels are price levels at which a financial instrument has historically stopped falling and may even experience a bounce or reversal to the upside.

Bounces and Breakouts

Price surpasses a significant level of support or resistance.

Backtesting Support

Historical performance of a trading strategy

Resistance Trading

Developing and implementing trading strategies based

Drawing Trendlines

Traders recognize direction of the trend, potential reversals

Support and Resistance importance

Selling pressure, reversal, or breakout.

In financial markets, selling pressure is a phenomenon where traders and investors actively sell a financial instrument, creating downward momentum in its price. This selling pressure can lead to different market reactions, including a bounce, reversal, or breakout.

Navigate market fluctuations

Define Trade. Achieve,Resistance

Several factors influence the outcomes of selling pressure, including trading volume, news and events impacting market sentiment, and the technical levels of support and resistance. Analyzing these factors allows traders to develop strategies for different market scenarios.Traders may employ various strategies during selling pressure, such as bounce trading, where they look for short-term gains as the price recovers from a support level.