Content for all your Trading

trading volume is calculated by adding up the total number of shares or contracts traded during a specific timeframe. For stocks, it represents the total number of shares traded, while for futures or options, it represents the total number of contracts.

Volume Analysis

Explore various methods for analyzing trading volume

Volume Across Securities

Analyze the differences in trading volume among various stocks or assets

Volume Patterns

Investigate volume patterns can vary throughout the trading day

Event-Driven Volume

Analyze how seasonal factors, economic events,

Visual content that tells a story

Visual content related to society can encompass a wide range of topics and themes, capturing the diversity, culture, and dynamics of human interactions. Here are some ideas for visual content that reflects various aspects of society.Showcase candid moments captured in everyday life on the streets. Highlight the diversity of people, cultures, and activities.

PRICE CONTROL

Next step: Greatness

If individuals are actively socializing, tweeting, or interacting with your brand on social platforms, they are the ones who hold significance for you. We'll support you in sustaining this engagement and extending your reach to a broader audience that matters most, utilizing targeted customer parameters.

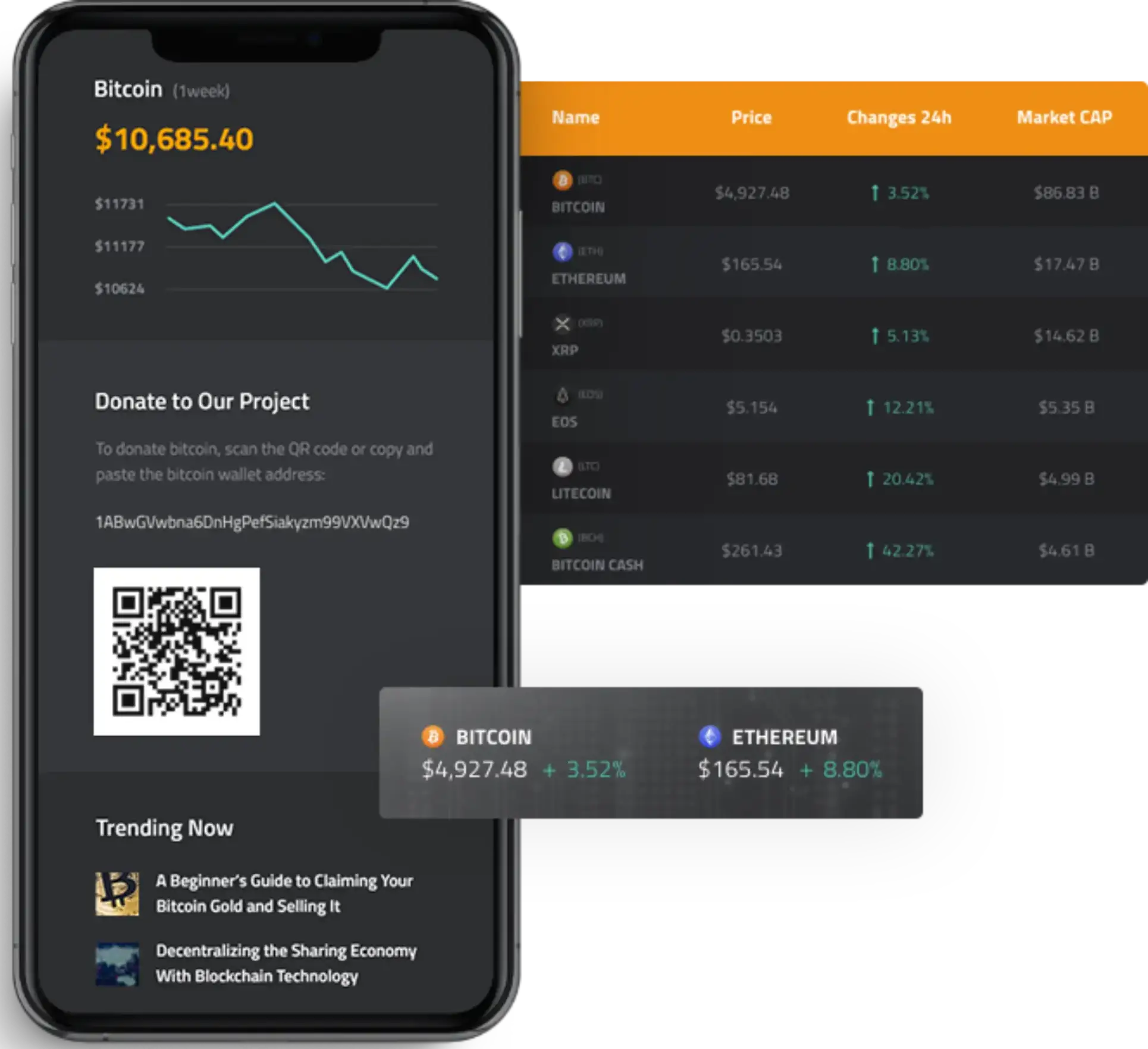

Cryptocurrency Markets

Core idea behind techical analysis is the market prices

Volume Impact

These are specific formations that occur on price charts

Volume Divergence

it indicates increases market activity and interest in the asset

Intraday Volume Patterns

They use these levels to identify potential entry and exit points

Urban Landscapes importance

Portraits of Diversity

High trading volume often accompanies strong price movements, signaling widespread market participation and conviction in the prevailing trend. It serves as a confirmation tool, reinforcing the credibility of price trends. Conversely, low trading volume during price movements may indicate a lack of conviction, potentially signaling a temporary or less sustainable trend.

Adapting to Changing Conditions

Volume Analysis Resources

Remember, incorporating volume analysis into your trading strategy requires a holistic approach, considering other technical indicators, price action, and market conditions. Continuous learning and adaptation to changing market dynamics are essential for effective trading with volume insights.